Multiple linear regression definition/method/Advantages

The multiple linear regression is a method used to measure the relationship which could save some independent variables in a statistical study. These studies can be of use on a financial or scientific level, to support and make known mathematical experimental results in a way that can be understood by society in general. Multiple linear regression definition

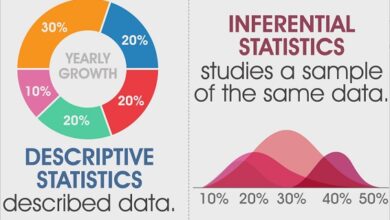

Statistics is fundamental in science since it is a practical way to apply an experiment on a finished number of the population and measure the results in an infallible way. Probabilities, samples and individuals are part of the statistical world and their classification and types can be very broad.

Multiple linear regression method

We can start by defining what is a technique used in statistics to establish a relationship between some dependent variables or to explain some independent variables. There are many important concepts related to this method that are important to know when performing a multiple linear regression.

Heteroscedasticity

This statistical concept refers to non-constant disturbances during the observations made, however, with respect to linear regression it implies not following the multiple linear regression model. Heteroscedasticity occurs in some cases when the data in a sample are values that have been averaged or have simply been aggregated. Multiple linear regression definition

Multicollinearity

This concept is linked to the explanatory variables and the correlation between them. The correlation between two variables will always occur unless the experiment is carried out in the specific conditions of a laboratory.

Exact multicollinearity

This important concept for understanding multiple linear regression is a form of multicollinearity that occurs when one or more variables are a linear combination of the other, which is also known as the correlation coefficient between two variables.

Approximate multicollinearity

This phenomenon occurs when it is not possible to affirm that one or more variables are a linear combination of the other, although there is a coefficient between them that is very close to each other. Multiple linear regression definition

How to analyze multiple linear regression

As we mentioned, this is a way to test hypotheses, however, to apply some parameters must be met, such as:

- The result or dependent variable must be presented on a scale, that is, they must be presented according to a hierarchy on a scale of one to ten.

- The causes must be scalar or nominal.

- There are other conditions such as in the case of independent variables that cannot be highly correlated with each other and all variables must follow the normal distribution.

F-test significance

If it is below 0.05, it can be stated that the model is statistically significant, in this case the independent variables would explain something, and the dependent variables could validate how much “something” is the R- squared. Multiple linear regression definition

R square

It is the result of how much is really explained through the dependent variables, the so-called independent variables. It is also known as the coefficient of determination and is also explained as the fit of a model to the variable it is trying to demonstrate.

Significance of t-test

It is applied when the population used for the study follows a normal distribution, however, the sample size is very small and has many uses in statistics, but in the case of linear regression it is used when if the slope in the statistic differs from zero.

Beta coefficient

The beta coefficient is widely used in the world of finance to calculate risky investments, but in the case of linear regression it indicates how intense and the direction that the relationship between dependent and independent variables follows. Multiple linear regression definition

How do you know if this model fits your data?

To start a linear regression model you must make sure that it adapts to the data that you have collected from the samples and the population, for this, certain conditions must be met, such as:

- The relationship between the variables must be linear.

- The errors in the measurement must be independent of each other.

- The variance of these errors must be constant.

- The expectation for these errors should be zero at the mathematical level.

- The total error must be the sum of each of the errors.

What are errors?

Within the statistical study and the linear regression model, the residuals or errors are the difference between the real values and the estimated values of the regression. They are used to assess the correlation between the measured values and the regression. Some statisticians prefer them over linear correlation coefficients since it is measured in the measurements of the values studied. Multiple linear regression definition

What are residual graphs?

Here you can graphically record the distribution of errors or residuals for the observations. With it, you can determine if the data is skewed or if some of the recorded values are outliers.

Interpretation of the residuals

Ideally, the resulting relationship is non-linear, in case you have used an inappropriate model there will be trends in the errors.

If the variables are constant or in case of having irregular dispersion, this type of graph will be very useful. The linear regression model assumes that the residuals are randomly distributed around zero.

Other Advantages of Multiple Linear Regression

Since in this model you will be able to obtain more explanatory variables, this offers having more information and having the opportunity to obtain a much more efficient and accurate estimate. That is, it is ideal for proving complex hypotheses. Multiple linear regression definition

It is widely used in the study of market trends and also has great advantages in scientific studies of medicine and health, for studies related to death and birth rates.

It has great advantages and is widely used in the financial world of investments to get to know what the risk of making a certain investment is. It is also used to predict consumption and spending which at the same time is related to the economy on a large scale and on a small scale as well.