Define certificate of deposit and process to obtain withExamples

Certificate of deposit

When talking about certificate of deposit , reference is made to a banking tool with which it is possible to save money with low risk, at the same time that it is invested, because through a certificate of deposit it is possible, thanks to interest, to quote an increase in savings, favoring the customer over time. In this article we will define the certificate of deposit

It can be said that a certificate of deposit is a special type of savings account , with which the money is protected against possible losses because the Federal Deposit Insurance Corporation insures an amount of up to $ 250,000 for these types of accounts.

However, through a certificate of deposit or CD, it is possible to achieve profits even faster than with an ordinary checking account , because banks usually pay a fixed fee with much higher interest than those offered with a regular savings account.

How is the process to obtain a Certificate of Deposit

In general, when opening a certificate of deposit, it is necessary to keep the funds deposited in the account without withdrawing them for a certain period of time.

If the money is withdrawn before the scheduled expiration date, then the owner of the account must pay a penalty in order to subsequently be able to make free use of their savings, considering that this means a significant reduction in the interest earned on through the CD.

Recommendations

Before choosing a certificate of deposit as a means of saving, it is important to consider certain factors such as the desired saving time , since the longer the saving time, the higher the interest rate and therefore the higher the earnings.

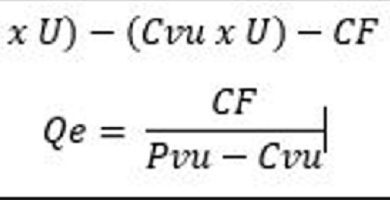

It is important to know that the certificates of deposit work through compound interest, that is to say that after a period of time the interest generated is incorporated into the capital, subsequently producing interest as well.

Examples of certificate of deposit.

- A certificate of deposit is an excellent option if you want to invest and save money over a long period of time, because it offers higher interest rates than ordinary savings accounts.

- A certificate of deposit works through the so-called compound interest, for which after a period of time the interests generated up to that moment would become part of the capital, thus also generating income.

- If you have contracted a certificate of deposit, but you want to withdraw the money deposited before the expiration date, you will have to pay a fine.